In a groundbreaking move to enhance regional connectivity and promote digital integration, Vietnam and Laos have officially introduced cross-border QR payment systems. This new initiative simplifies financial transactions for travelers, businesses, and local communities, making travel between the two countries more convenient and efficient. This comprehensive guide explores the key details of the cross-border QR payment system, its significance, and the benefits it brings to travelers and the broader economy. Vietnam and Laos have introduced cross-border QR payments to enhance travel convenience. With a Laos eVisa, entering the country becomes easier, and now, digital payments make your journey even smoother.

What Are Cross-Border QR Payments?

Cross-border QR payments allow users to make payments in one country using a QR code and their home currency, while the transaction is seamlessly converted into the local currency of the destination country. This system leverages digital payment platforms and mobile banking applications, offering a cashless and hassle-free way to pay for goods and services.

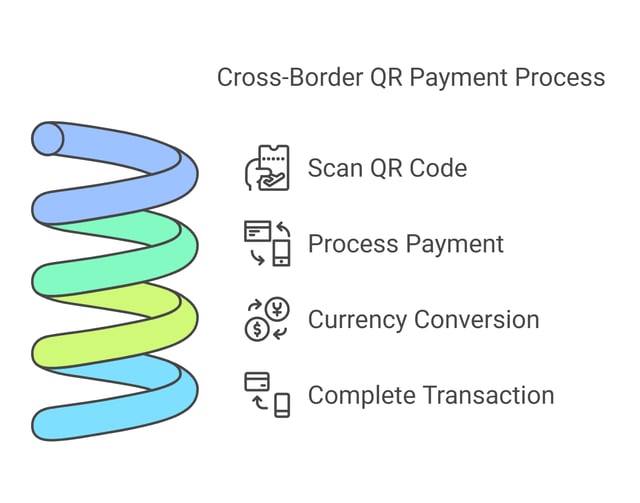

How It Works:

- Travelers or consumers scan a QR code provided by merchants.

- The payment is processed through the payer’s mobile banking or e-wallet app.

- The amount is automatically converted into the recipient's local currency at the prevailing exchange rate.

- The payment is completed instantly, eliminating the need for physical cash or currency exchange.

The Vietnam-Laos Cross-Border QR Payment System

The cross-border QR payment system was developed through a collaborative effort between the State Bank of Vietnam (SBV) and the Bank of the Lao People’s Democratic Republic. Backed by key financial players such as the National Payment Corporation of Vietnam (NAPAS) and the Lao National Payment Network (LAPNet), the project also involves several leading commercial banks operating in both nations.

Seven major Vietnamese banks, including Vietinbank, BIDV, and Vietcombank, now offer QR payment services for seamless transactions in Laos. The service integrates with LAPNet’s network of 14 banks in Laos, ensuring widespread accessibility and convenience for users.

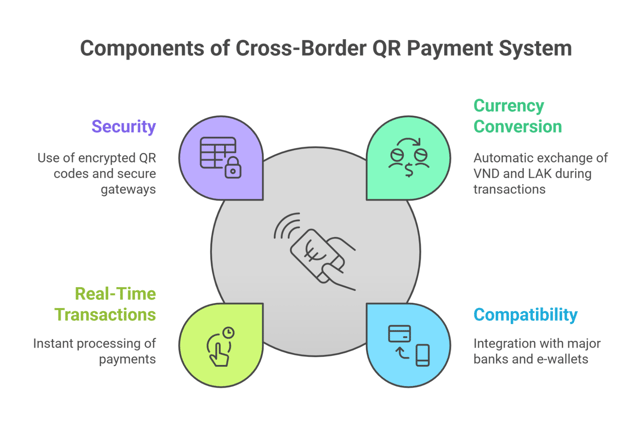

Key Features Include:

- Currency Conversion: Vietnamese dong (VND) and Lao kip (LAK) are exchanged automatically during transactions.

- Compatibility: Major banks and e-wallet providers in both countries have integrated the system, ensuring widespread accessibility.

- Real-Time Transactions: Payments are processed instantly, minimizing delays and ensuring accuracy.

- Security: The system uses encrypted QR codes and secure payment gateways to protect user data and prevent fraud.

Benefits of Cross-Border QR Payments

The introduction of this cross-border payment system is expected to bring numerous benefits:

|

1) For Travelers: – Convenience: No need to carry large amounts of cash or deal with currency exchange services. Payments can be made at a wide range of establishments, including hotels, restaurants, and transportation hubs. – Cost Savings: Competitive exchange rates compared to traditional currency exchange services. Reduced reliance on international credit cards, which often incur high transaction fees. – Ease of Use: Payments can be made with just a smartphone and a compatible app, simplifying the payment process. |

|

2) For Businesses: – Increased Sales: Businesses can cater to a broader audience, including Vietnamese and Lao travelers, without the need for complicated currency handling. – Efficiency: Digital payments streamline accounting processes and reduce the risk of cash-related errors or theft. |

|

3) For the Economy: – Boosted Tourism: The seamless payment system encourages more cross-border travel, benefiting the tourism sectors of both countries. – Enhanced Financial Inclusion: The initiative supports digital payment adoption in rural areas, bridging the gap between urban and remote communities. |

Adoption and Rollout

The cross-border QR payment system is being adopted swiftly, with major financial institutions in Vietnam and Laos embracing the technology. This rollout ensures that both tourists and locals can enjoy a seamless, modern payment experience across the region.

Participating Banks and Platforms:

Major banks and e-wallet providers in Vietnam and Laos have already integrated QR payment capabilities, including:

- Vietnam: Vietcombank, BIDV, and MoMo.

- Laos: BCEL (Banque pour le Commerce Extérieur Lao), Lao Development Bank, and OnePay.

Merchant Adoption:

- The system has been rolled out in popular travel destinations such as Luang Prabang, Vientiane, and Hanoi, with merchants trained to accept QR payments.

- Small businesses, street vendors, and rural merchants are also being encouraged to adopt the system, thanks to government-backed incentives.

Enhancing Travel Between Vietnam and Laos

The introduction of cross-border QR payments greatly simplifies travel for citizens of both countries.

Simplified Travel Experience:

- For Vietnamese Travelers in Laos: They can use their existing mobile banking or e-wallet apps to pay in Lao kip without worrying about currency exchange.

- For Lao Travelers in Vietnam: Similarly, Lao citizens can make payments in Vietnamese dong using their home apps.

Encouraging Cross-Border Mobility:

- Tourism: Easier payments promote travel to cultural landmarks such as the Plain of Jars in Laos or Ha Long Bay in Vietnam.

- Business: Cross-border traders can now transact more efficiently, eliminating cash-related bottlenecks.

Challenges and Considerations

While the cross-border QR payment system brings significant benefits, some challenges need to be addressed:

- Digital Literacy: Efforts are needed to educate users, especially in rural areas, on how to use the system effectively.

- Infrastructure Gaps: Reliable internet access is essential for seamless transactions, which may be a limitation in remote regions.

- Currency Volatility: Frequent fluctuations in exchange rates could impact transaction costs for users.

A Step Towards a Connected Future

The Vietnam-Laos cross-border QR payment system is a step toward broader regional integration. It aligns with ASEAN’s push for greater financial connectivity and supports the following initiatives:

- Expanding to Neighboring Countries: The success of this system could inspire similar collaborations with Thailand, Cambodia, and China.

- Promoting Digital Currencies: The system lays the groundwork for the eventual adoption of central bank digital currencies (CBDCs) in the region.

- Boosting Trade: Enhanced payment systems could support increased trade volumes between Vietnam and Laos, strengthening economic ties.

Conclusion

The introduction of cross-border QR payments between Vietnam and Laos is a transformative development, making travel and trade between the two countries easier and more efficient. By eliminating the need for cash and simplifying transactions, this initiative enhances the travel experience, fosters regional cooperation, and supports the broader goals of digital integration in Southeast Asia. Travelers, businesses, and local economies stand to benefit greatly from this innovative step forward, setting a new standard for cross-border financial connectivity in the region.